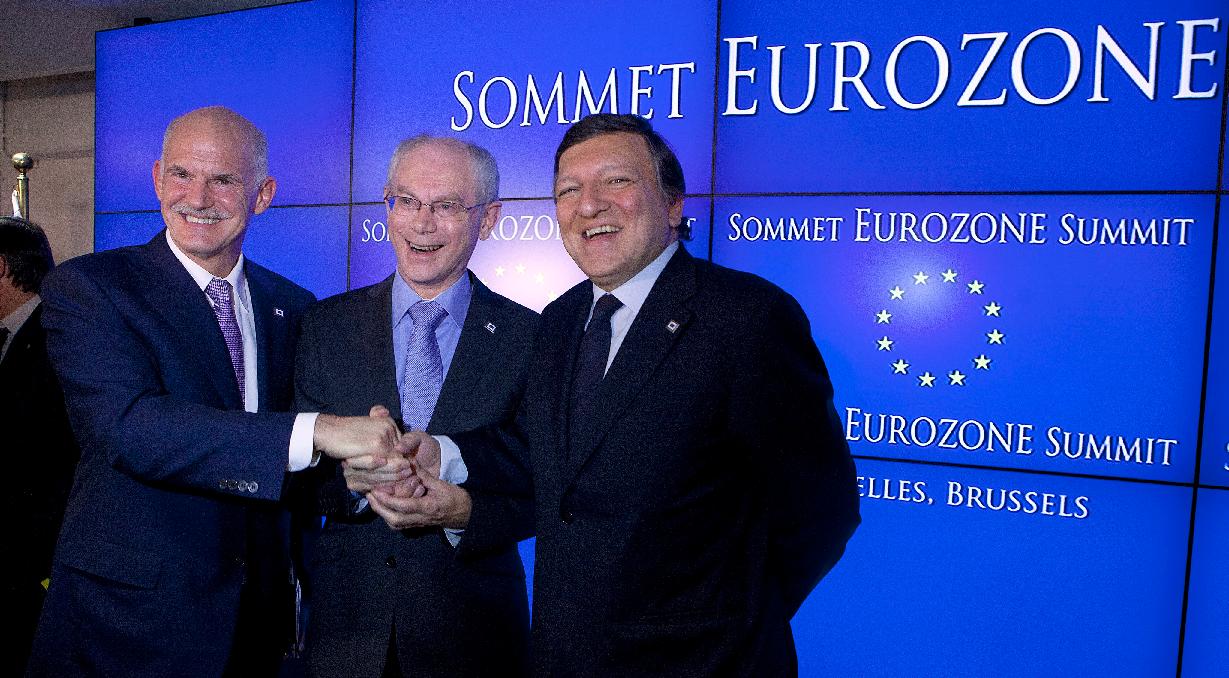

(L to R) Greek Prime Minister George Papandreou, European Council President Herman Van Rompuy, and European Commission President Jose Manuel Barroso give a news conference at the end of eurozone heads of state meeting at the European Council headquarters in Brussels, 21.07.2011. Photo: PAP/EPA/Olivier Hoslet

The eurozone agreement consists of a package designed not only to lift the burden on Greece’s debt, but to prevent other European economies from sinking.

Apart from the 109 billion euro bailout deal, the package also includes varying options as to how Greece is to repay the debt.

A flurry of announcements on the Twitter microblog service came on Thursday night in wake of the decision.

“Finance Min. J.Rostowski welcomes the adoption by Heads of States & Governments of Eurozone the Polish Presidency’s postulate expressed two weeks ago to lower interest rate of bailout for Greece, Ireland & Portugal to apprx. 3.5%,” wrote Polish EU Council Presidency spokesman Konrad Niklewicz on the service.

The announcement of the aid package has not pleased everyone, however. Nigel Farage, MEP from the Euro-sceptic United Kingdom Independence Party, wrote on Twitter that “the latest EU bailouts are just a bigger sticking plaster which will delay but not stop the inevitable,” and that to think problems in the eurozone will not continue “is laughable.”

This view is echoed by former MEP Dariusz Rosati, an economic analyst and former Polish foreign minister, told Polish Radio that the bailout package is only buying time for Greece but is not a way out.

Interviewed by Polish Radio One on Friday morning, Rosati said the weak point of the aid package is that it does not entail a restructuring of Greece’s debt.

Greece’s current debt constitutes 160 percent of GDP and is to be trimmed down to 60 percent. Rosati believes that the austerity measures which Greece will have to introduce will be too painful for it.

Asked why the eurozone crisis matters to Poland, Dariusz Rosati explained that “this is a system of connected vessels. [Poland] is not in the eurozone but its currency is reacting strongly to what is happening. If a risk appears in the eurozone, the Polish zloty loses much more in value than the euro itself.”

“We have also to remember that the eurozone is Poland’s biggest export market, so when a crisis hit there, Polish enterprises will suffer too. That’s why it is in Poland’s interest to solve this crisis as fast as possible,” Rosati said. (jb/kk)

Source: IAR/PAP/BBC

Audio by Slawek Szefs